Your desired portfolio

Where do you want to invest?

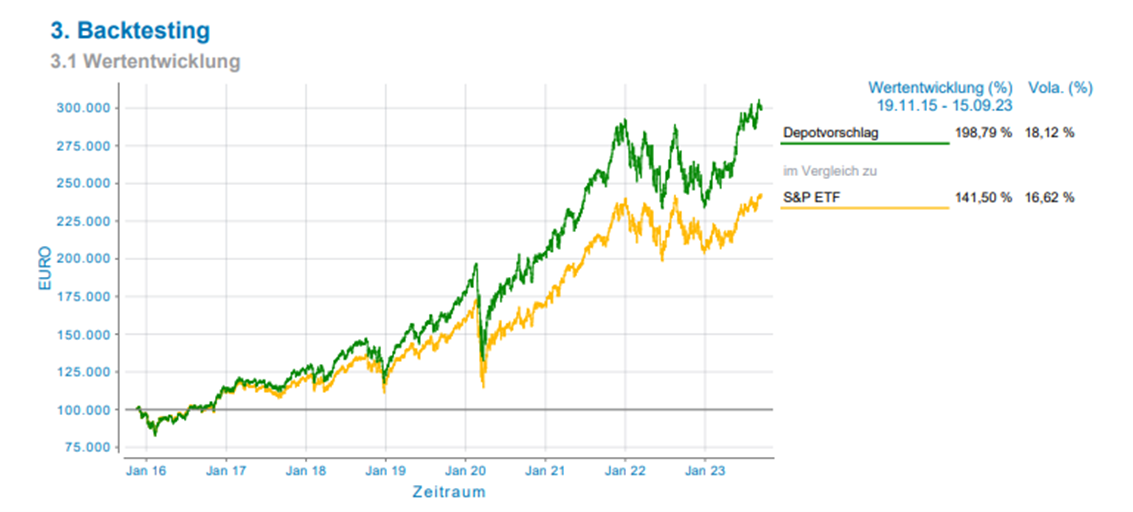

Yellow: pure ETF on the S&P 500. Green: 70 % ETF on the S&P 500 and 30 % Technoloigy. A significantly better return with slightly more fluctuations.

Yellow: pure ETF on the S&P 500. Green: 70 % ETF on the S&P 500 and 30 % another technology fund. Here too: A significantly better return with slightly more fluctuations.

The technology sector remains a strong driver of global change. Advances in innovation in areas such as artificial intelligence, cloud computing and 5G could continue to drive growth. Investments in technology ETFs could benefit from the ongoing digitalization and demand for advanced technology solutions.

The healthcare industry is facing challenges, but also opportunities. Advances in biotechnology research and personalized medicine could lead to breakthrough therapies. Healthcare ETFs could benefit from innovations in medicine, demographic change and global healthcare initiatives.

The financial sector remains closely linked to economic development. Interest rate changes, fintech innovations and the growing importance of sustainable financial products could influence the financial sector. Financial ETFs could benefit from economic growth, regulatory changes and technological progress.

The energy sector is in transition as the world moves increasingly to renewable energy sources. Energy ETFs could benefit from investments in renewable energy, energy efficiency and global energy transition.

The consumer sector is strongly influenced by changes in consumer trends. Consumer goods ETFs could benefit from developments in the areas of e-commerce, luxury goods and sustainable consumption.

The industrial sector is facing challenges such as trade tensions and supply chain disruptions. However, industrial ETFs could benefit from global infrastructure projects, automation and increasing globalization.

Materials ETFs could benefit from global construction and infrastructure projects, the growing demand for raw materials for high-tech applications and sustainable procurement practices.

The telecommunications sector is undergoing a transformation due to 5G technology and the expansion of broadband infrastructure. Telecommunications ETFs could benefit from these developments as well as from mergers and acquisitions in the sector.

Utilities are traditionally known as defensive investments. Utility ETFs could benefit from the rising demand for renewable energy, energy efficiency and the modernization of energy infrastructure.

The real estate sector can be influenced by urbanization, changing ways of working and sustainable urban planning. Real estate ETFs could benefit from these trends as well as from developments in the area of smart cities and real estate innovations.

The hydrogen sector is gaining in importance as clean energy sources become more relevant. Hydrogen ETFs could benefit from innovations in hydrogen production, storage and use.

The AI industry is experiencing exponential growth. AI ETFs could benefit from advances in machine learning, automation and data analytics.

A boring but stable international portfolio could consist of a mix of broadly diversified ETFs that focus on established markets. These funds offer balanced exposure to global markets and may be suitable for investors seeking stability and diversification.

With increasing digital threats, the cybersecurity industry is gaining in importance. Cybersecurity ETFs could benefit from the growing demand for solutions to protect against cyberattacks.

The sustainability industry is seeing growing interest as companies increasingly integrate environmental, social and governance (ESG) practices. Sustainability ETFs could benefit from investments in environmentally friendly technologies, socially responsible companies and ethical practices.

The global infrastructure sector is becoming increasingly important as countries around the world invest in expanding their infrastructure. Infrastructure ETFs could benefit from projects in the transportation, energy and communications sectors.

Precious metals are traditionally known as safe havens and can become more attractive in times of economic uncertainty. Precious metal ETFs allow investors to invest in physical precious metals such as gold, silver, platinum and palladium without actually holding physical bars or coins.

Water is a vital resource and access to clean water is increasingly becoming a global challenge. Water ETFs allow investors to invest in companies that are active in water supply, technology and infrastructure.

The agricultural sector plays a central role in global food production. Staple food funds allow investors to invest in companies active in agriculture, food processing and distribution. Such funds can benefit from developments in global food production and rising demand for agricultural commodities.

Cryptocurrencies have attracted considerable attention in recent years and form an emerging sector in the financial world. Cryptocurrency funds allow investors to invest in digital assets such as Bitcoin, Ethereum and other cryptocurrencies without physically holding them. It is important to note that cryptocurrencies come with increased risks, including volatility and regulatory uncertainty.

There are many more, such as agriculture, gaming, etc.

A balanced portfolio could consider these different themes and industries to ensure broad diversification and adaptation to different megatrends. It is important to consider individual investment goals and risk tolerance before investing in specific industries.

Do you have any other ideas? Then let me know.

Give me a call or make an appointment directly here. We will then have an initial conversation to find out whether we are a good fit and whether we can go down a path together. I look forward to it